Back to Work by Clinton

Ref: Bill Clinton (2011). Back to Work. Knopf Publishing.

_________________________________________________________

Summary

How can we move back to a full-employment economy with good jobs and rising middle-class incomes? How can we restore American leadership for peace and prosperity and leave our children and grandchildren a brighter future? What do Americans need government to do to achieve these goals? How are we doing now, compared with our own history and expectations? How are we doing compared with the competition from other nations?

America is the world’s most entrepreneurial country.

Today, our process is too tilted in favor of powerful private interests over the public interest, in favor of short-term financial gains over long-term employment and income growth, in favor of consumption over investment, in favor of pushing more of our national income up to the top 1% over increasing the incomes of the middle class and giving poor people a chance to work their way into it.

I think the role of government is to give people the tools and create the conditions to make the most of our lives. Government should empower us to do things we need or want to do that we can only do together by pooling our resources and spending them in large enough amounts to achieve the desired objectives.-Bill Clinton.

The most Important Issues in the USA today:

National security, including the military, intelligence agencies, diplomatic efforts and development assistance, homeland defense, federal law enforcement, border control, natural-disaster response, and the area most recently added to the list by the Pentagon and the CIA, combating climate change.

Assistance to those otherwise unable to fully support themselves and to provide a decent retirement for seniors, including Medicaid, Medicare, and Social Security, aid for the disabled, food stamps, unemployment benefits, nutrition aid for newborns and mothers, and public housing.

Equal access to opportunity, including federal aid to education for low-income and disabled students, the HOPE Scholarship tax credits for college tuition costs, the student-loan program, Pell Grants, work-study payments, and job-training assistance.

Economic development, including trade agreements; financing for businesses to enter new markets; incentives to create new businesses and jobs in advanced manufacturing, clean energy, energy efficiency, and other high-growth areas; investments in basic research and development and incentives for private research and development to be done in the United States; an adequate minimum wage and support for work and child-rearing, including the Family and Medical Leave law and the child tax credit; Small Business Administration–guaranteed, microcredit, and community development loans to promising businesses that would otherwise be shut out of credit markets; financing and other support to help companies sell products made in America in other countries; and incentives to invest in areas of high unemployment and low incomes.

Oversight of financial markets and institutions to ensure transparency and honest dealing, competition, and consumer choice and to limit leverage to avoid future collapses and bailouts.

Protection and advancement of public interests the market can’t fix, including clean air, clean water, safe food, safe transportation, safe workplaces, civil rights, access to affordable health care, and preservation of natural resources for the common good, including national parks, national monuments, and national forests.

Providing investments, through tax or fee revenue, for projects we all need when the costs are too great or the cost recovery period too long for the private sector to finance, including highways, airports, rails, accelerated broadband connections, a national electric grid, and critical research and development in areas from space to advanced materials to nanotechnology and biotechnology to clean energy.

A revenue collection system, to collect taxes and issue credits and deductions deemed by Congress to be in the national interest, including tax deductions for home-mortgage payments, charitable giving, health-care payments, children, and many business expenses and deductions.

What we need is real arguments based on real facts that produce real results through principled compromise based on what works.

In this new, multipolar world, we can still be the world’s best innovator; the world’s best producer of new products and services; the world’s best assimilator of people from every nation, race, religion, and culture; and the world’s best example of shared opportunity and responsibility, demonstrating the power of both individual freedom and close cooperation and proving both the genius of free markets and the necessity of active government.

_________________________________________________________

Misc Quotes

Willingness to revise views in the face of empirical data is the hallmark of the good scientific process.

Criticizing the government is part of the birthright of every American.

_________________________________________________________

Foreign Aid

For decades, every time the American people have been asked how to balance the budget, the first thing they say is “Cut foreign aid.” When asked how much of the budget we should spend on foreign aid, people normally say about 10%. When asked how much we do spend, they say between 15 and 25%. The difference is a lot of money. The problem is that for decades our spending on foreign assistance has been around 1% of the budget. That’s where it still is, even with substantial development spending in Afghanistan and Iraq. Almost all other wealthy countries spend a higher percentage of their budget on foreign assistance than we do.

An adequate foreign assistance budget for the State Department is essential to our national security.

_________________________________________________________

World Trade Organization (WTO)

We’re part of the World Trade Organization’s Government Procurement Agreement, in which the signatories promise not to discriminate against each other’s companies in bidding on government contracts.

_________________________________________________________

—Climate Change—

The science behind climate change represents nothing more than "a neutral description of reality."

The main reason there has been no international agreement to cut greenhouse-gas emissions is that too many decision makers still don’t believe we can do it without curbing economic growth and too many carbon emitters keep reinforcing that notion.

The world’s growth pattern is unsustainable, because the way we produce and use energy and deplete natural resources is causing climate change and other environmental problems.

The status quo is represented by much more powerful lobbying groups than the future is.

The Pentagon, much to the chagrin of climate deniers in Congress, has recognized climate change as a threat to our national security. The Pentagon has conducted war games and ordered intelligence studies to determine the range of problems that rising temperatures, droughts, food shortages, melting glaciers, and high sea levels present to our security, and it is working on a range of possible responses to them.

Unlike our major competitors, the United States hasn’t passed legislation to limit carbon emissions through a cap-and-trade system or a carbon tax, or adopted a clear standard to increase the percentage of our electricity generated by clean energy by a fixed date, or committed to a clear long-term strategy of incentives to encourage large investments in clean energy and efficiency.

Transportation

Transportation is responsible for about 25% of America’s greenhouse-gas emissions.

Agriculture

In recent years, more than a third of our corn crop has gone to fuel production. The subsidy has been heavily criticized in the United States and abroad because of rising corn prices, global food shortages, and the relative inefficiency of corn ethanol compared with other biofuels. The problem with corn is that it produces barely 2.5 gallons of biofuel for every gallon of oil required to make it, compared with 4 gallons or more for other biofuels and 9.3 gallons for fuel produced from sugarcane.

Energy

The federal government is America’s largest consumer of energy and the DoD is responsible for 80% of it. The US military tries to make decisions based on evidence and has a proven capacity to solve problems in partnership with the private sector. The U.S. Army already has 126 renewable-energy projects under way. McHugh has set up a task force with a mandate to determine how the army can get 25% of its energy from renewable sources by 2025, with an investment of more than $7 billion in a clean-energy infrastructure.

Energy efficiency is the perfect laboratory. It creates jobs, lowers costs, saves energy, and improves the environment. We should be clearing roadblocks to innovation, not erecting them.

Shipping conventional fuel into high-temperature combat zones just for air-conditioning costs the Pentagon billions of dollars a year in fuel, transportation, security, and medevac expenses. For Afghanistan, fuel is shipped into Karachi, Pakistan, then driven eight hundred miles on terrible roads for more than two weeks through dangerous territory. A lot of U.S. soldiers have been killed in those and other fuel convoys. If our troops had had bases equipped with solar panels to run the air conditioners and keep the lights on, it could have saved money and lives and driven continued price reductions and technology improvements beneficial to the entire economy. Solar cells, a few backup generators with a small amount of fuel to run them, and relatively inexpensive batteries that store solar power for cloudy days could have made a big difference in Afghanistan and Iraq and still can in many less hazardous places where our troops are deployed, including at forts in the United States.

Our electrical grid is divided into 140 largely autonomous areas of varying capacity. This leads to electricity disruptions that cost the economy $100 billion a year.

Coal Power

Many old coal-fired plants are scheduled to be closed in the next few years. They’re big producers of CO2; the oldest 10% are responsible for about 40% of total CO2 emissions from coal plants.

Nuclear Power

The US has 104 reactors that produce about 20% of America’s electricity at 65 sites.

The industry is already heavily subsidized, yet new nuclear plants are basically uninsurable and so expensive to build that the estimated cost of power from them is $.25-.30 per kWh, three times today’s rates and twice as high as solar power.

2005: The Energy Policy Act of 2005; Congress agreed in effect to insure the nuclear industry against losses in building new power plants, since no private insurance company will issue policies to do so.

Wind Power

USA wind power potential is staggering—37 trillion kWh, almost ten times our existing needs.

If the transmission capacity were there, North Dakota alone could provide 25% of our nation’s electricity demand with wind.

Geothermal

The USA leads the world in geothermal capacity, with 3,100 MW, though Iceland and the Philippines generate a higher percentage of their electricity with it because of their unique geology.

The price of geothermal power, at three to five cents per kWh, is highly competitive.

Natural Gas

As we develop other sources of clean power, we should use natural gas as a bridge fuel. It’s the cleanest fossil fuel, more than 50% cleaner than coal in terms of greenhouse-gas emissions, 25% cleaner than oil when used in transportation, and only one-fourth as expensive.

The primary controversy over natural gas concerns the most efficient technology for its extraction, called fracking. It’s alleged that the injections of a chemical solution into underground fissures to release and push the gas into more accessible and less costly recovery positions pollute water supplies and pose other health challenges. So far, studies in the areas where fracking has been most criticized don’t seem to support the claim, but there is some troubling anecdotal evidence.

Economics

Almost all the costs of solar and wind power are front-loaded, while the economic benefits in lower annual costs take time to realize. And building a new coal-fired power plant is simple. A utility gets approval from one regulatory body, hires one contractor to build the plant, secures a supplier of the coal, and gets to bill the customers over a twenty-year period, merging the cost of the plant with the annual cost of the coal. The annual costs of solar and wind are almost nothing, but the up-front costs are high (though dropping steadily as production goes up and technology improves), without a coal-like payback option of twenty years.

On average, every billion dollars invested in a new coal-fired plant yields 870 jobs. The same amount invested in solar creates 1,900; in wind, 3,300, if the turbines and blades are made in the country where they’re put up; in big building retrofits, 7,000; in home retrofits, up to 8,000 jobs.

Emission Reduction Solutions

Paint Roofs white. The black tar roofs covering hundreds of thousands of American buildings, especially in older cities, absorb a huge amount of heat, requiring much more energy to cool the rooms below. Just painting the roof white can cut a building’s energy use by up to 30% on a hot day.

We can get even greater energy savings and lower bills by planting greenery or growing gardens on rooftops.

Reinstate the full tax credit for new green-technology jobs.

Finish the smart grid, with adequate transmission lines, at least enough to connect the areas where the wind blows hardest and the sun shines brightest to the population centers that use the most power.

There are real benefits in converting solid waste into power: closing landfills; building recycling businesses in plastic, metal, glass, and organic fertilizer; and using the rest to provide steam heat to power factories or provide electricity for the grid. We should turn more landfills into power generators.

Develop our natural gas resources.

THE SUREST WAY TO CREATE JOBS, cut costs, enhance national security, cut the trade deficit by up to 50%, and fight global warming is to change the way we produce and consume energy.

International Examples

Sweden: Reduced emissions through greater efficiency, growing its economy more than 50% while reducing its C emissions 7% below 1990 levels.

Germany: the world’s #1 user of solar cells, putting up a lot of windmills, and increasing efficiency.

U.K.: Substituted natural gas for coal, developing its offshore wind capacity, and promoted large-scale efficiency projects.

Denmark: generate almost 25% of their electricity from wind, have biomass (waste-burning) power plants, and high home efficiency standards, including triple-paned windows, more insulation, heat pumps, and solar panels. Farmers are encouraged to put up their own windmills, which they can pay off in three years with savings from lower electricity costs, then earn a 12% profit on energy they sell to utilities. The results? The Danish economy expanded by 75% with no increase in fossil fuel use.

_________________________________________________________

—Finance—

Glass-Steagall Act: A Depression-era law requiring commercial and investment banking to be done by separate institutions.

Securities and Exchange Commission (SEC): oversees investment banks; lacked the authority to require them to set aside more cash to cover high-risk investments.

Simpson-Bowles Commission: The bipartisan National Commission on Fiscal Responsibility and Reform.

The Budget

The Clinton Administration balanced the budget with a balanced plan: with both spending cuts and tax increases on the wealthiest corporations and individuals (the top 1.2%) who had benefited disproportionately from America’s growth and from tax cuts in the 1980s; strengthened regulations to get cleaner air and water and safer food; appointed an SEC commissioner who believed in firm oversight of investment banking practices; set aside more land for preservation in the lower forty-eight states than any president since Teddy Roosevelt; added years to Medicare’s and Social Security’s solvency; doubled spending on education, including the largest increase in aid to college students since the GI Bill; spent more on education, transportation, and child care to help people move from welfare to work; achieved almost universal access to the Internet in schools, hospitals, and libraries; doubled investment in biomedical research and created the Children’s Health Insurance Program, the biggest expansion of health coverage since Medicare and Medicaid; created the COPS program, which put 100,000 police on America’s streets; and enacted the Brady Bill and the assault weapons ban, leading to the longest continuous drop in crime in our history—all ideological nonstarters for passionate antigovernment advocates, but all good for America.

Discretionary nondefense spending claims only 15% of the Budget. Included in that 15% are our investments in the future—in education, infrastructure, clean energy, research. Our quality-of-life budget is also there—in a clean environment, safe food, air traffic control, a safe workplace, and much more.

Non-Discretionary Spending claims 85% of the Budget and includes Medicare, Medicaid, Social Security, the defense budget, and interest on the debt claim.

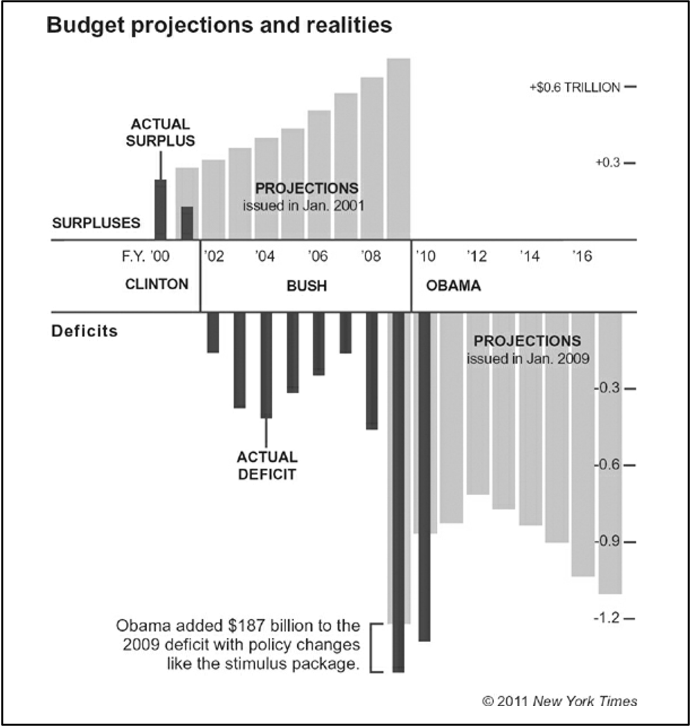

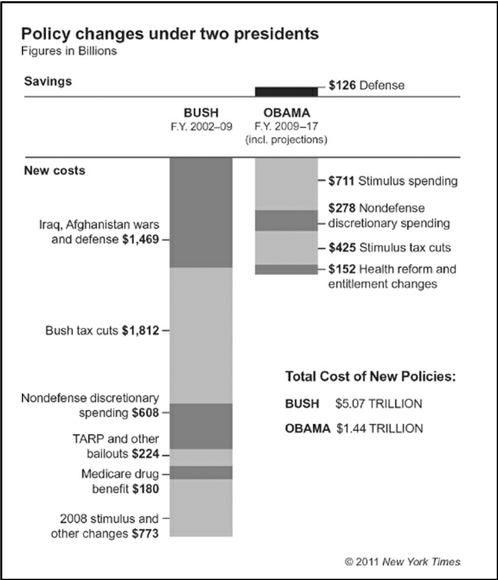

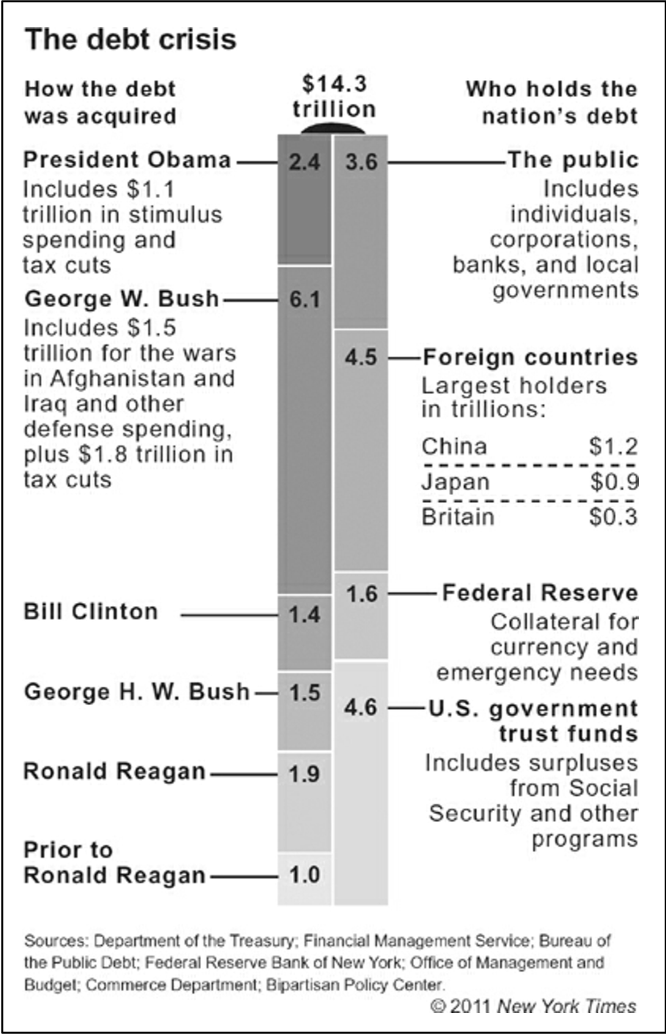

From 2001 to September 2008, tax cuts, spending increases, and weak job growth (fewer taxpayers, more benefits users) doubled the debt again. Then the recession hit, and the tax relief and increased spending passed to put a floor under it, plus lower tax receipts and more people eligible for food stamps, medical benefits, and unemployment, added another $3 trillion to the debt. Now it’s up to 69% of our GDP and rising.

The debt is projected to grow to 100% of GDP by 2021 and almost 200% by 2035. We can’t let this happen. If it does, interest rates will explode, our GDP will be reduced, and our children’s future will be compromised. There are only three things we can do to turn the debt problem around before it becomes a crisis: restrain spending below current projections, raise taxes, and grow the economy faster. We have to do all three.

Taxes

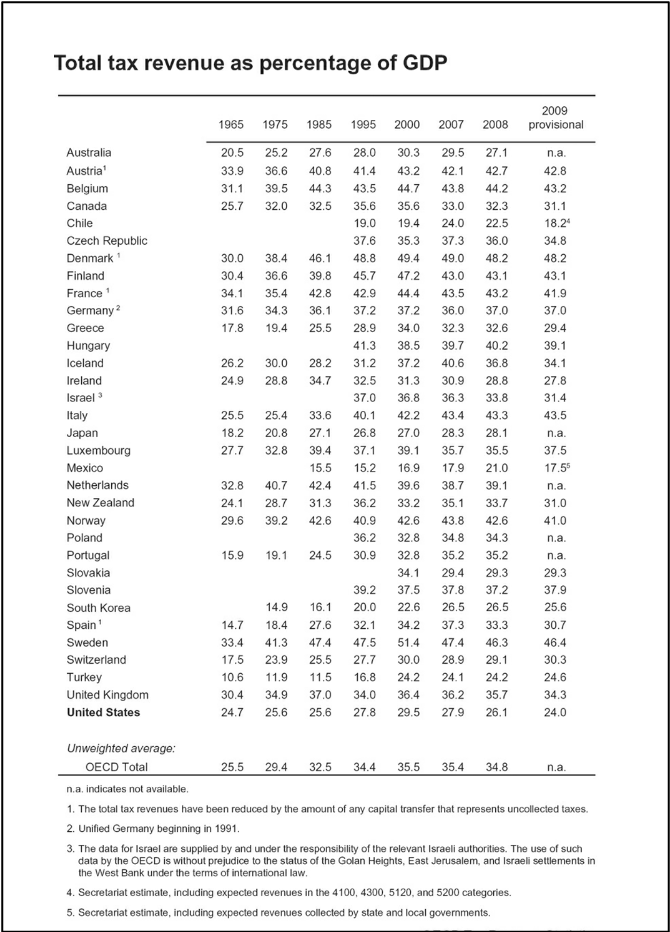

We rank 31st in the percentage of GDP directed to taxes, with only Mexico and Chile taking a smaller percentage, and we’re twenty-fifth in the percentage of GDP devoted to government spending.

Imports/Exports

Germany is the number-one exporter in the world. Exports account for more than 40% of its GDP, compared with 11% for the United States.

Our trade deficit is largely with the countries we buy oil from and the countries we borrow lots of money from, China and Japan.

Oil imports comprise about half our trade deficit.

Housing Market Collapse

First, the meltdown happened because banks were overleveraged, with too many risky investments, especially in subprime mortgages and the securities and derivatives that were spun out of them, and too little cash to cover the risks. There was not enough government oversight or restraint on excessive leverage.

Bear Stearns was leveraged at 35:1 when it failed.

Unregulated financial derivatives markets increased sevenfold in just seven years, to $700 trillion.

Many Americans who didn’t take out risky mortgages and are making their payments every month don’t think it’s fair to modify the mortgages of people who shouldn’t have taken them out in the first place and should face the consequences of their mistakes. That’s a defensible position that in normal times should govern our policy. But it shouldn’t control our actions today. Why? Because the housing market collapse has hurt the entire economy so much that a lot of people who can’t make mortgage payments today were reasonable in thinking they’d never default when they signed the mortgage papers. Because every foreclosure punishes more people than the imprudent borrower, it drives down the prices of all the houses in the neighborhood. And because now so many homes have been foreclosed on, or are about to be, the total impact has depressed overall housing values, shrinking the biggest source of family wealth for millions of innocent bystanders. The over 25% of mortgages now worth more than their homes’ value includes many on which payments are not delinquent. And if they’re written down on terms that require the owner to share future profits with the lender if the house rises in value, the so-called moral hazard argument has much less force.

Troubled Asset Relief Program (TARP): originally authorized to spend up to $700 billion and spent a bit over $400 billion. Most of the TARP money has been paid back, with only $104 billion still outstanding.

_________________________________________________________

—Social Welfare Programs—

Social Security

Financed by a payroll tax at 1.45%.

Though most seniors have other sources of income, almost half of them would fall below the poverty line without their monthly Social Security checks.

Because it is not paid in cash, the Social Security fund is nowhere near broke, yet it has begun to run a cash-flow deficit, $45 billion in 2011. That means that this year beneficiaries’ checks will be funded in part from money borrowed from U.S. and overseas buyers of our bonds. The amount we borrow will continue to grow as the baby boomers move into retirement age, unless the rest of the government begins to operate with a surplus sufficient to cover Social Security’s outlays or slows the projected increase in the program’s cost.

Healthcare

While the United States spends 17.4% of GDP on health care, the next most expensive system in a large, wealthy country is France at 11.8%. The other wealthy countries spend as little as 8.5% (Japan) of GDP.

Led by for-profit insurance companies, our health-care system spends about eleven cents on the dollar more on paperwork and administration than any other wealthy nation. That’s more than $200 billion a year.

Medicare

Financed by a payroll tax at 1.45%.

_________________________________________________________

Democrats

Realize that shared prosperity is a better formula for success and happiness than “you’re on your own,” and big enough to admit we’re all going to be wrong once in a while.

Liberals want to use the government to solve problems and are usually eager to experiment, believing, like Robert Browning’s Andrea del Sarto, that “a man’s reach should exceed his grasp.” True conservatives are more cautious, reminding us that if something sounds too good to be true, it probably is. Liberals believe that government can solve social problems, or at least mitigate them. Conservatives believe culture, including a strong work ethic and stable families, matters more. Progressives believe they can advance liberal goals in a way that reinforces positive cultural norms and avoids “too good to be true” options. Libertarians caution against the potential of even well-conceived government initiatives to restrict individual liberty.

_________________________________________________________

Republicans

Our constitution was designed by people who were idealistic but not ideological. There’s a big difference. You can have a philosophy that tends to be liberal or conservative but still be open to evidence, experience, and argument. That enables people with honest differences to find practical, principled compromise. On the other hand, fervent insistence on an ideology makes evidence, experience, and argument irrelevant: If you possess the absolute truth, those who disagree are by definition wrong, and evidence of success or failure is irrelevant. There is nothing to learn from the experience of other countries. Respectful arguments are a waste of time. Compromise is weakness. And if your policies fail, you don’t abandon them; instead, you double down, asserting that they would have worked if only they had been carried to their logical extreme.

No matter what the problem, apart from national security, the solution is always the same: less government, lower taxes, weaker regulations. At its core, this has been the modern Republican Party’s credo since President Reagan rode it to victory in 1980.

_________________________________________________________

Chronology

Mar, 2011: two professors at New York University’s Stern School of Business, the Nobel Prize winner Michael Spence and his colleague Sandile Hlatshwayo, released a fascinating study, The Evolving Structure of the American Economy and the Employment Challenge. They found that almost all our job growth over the last several years had come in “non-tradable” areas like government, health care, and other services like real estate and food services, while most of our income growth had come in “tradable” areas like high-end manufacturing, where productivity increased more in the jobs big companies kept in the United States, as they moved more of the less productive jobs offshore. Meanwhile, slower productivity growth in the non-tradable sector, and more competition for available jobs, kept wages and benefits from growing or even keeping up with inflation.-Back to Work by Bill Clinton.

Jul, 2011: President Obama announced an agreement involving Ford, GM, Chrysler, and ten other manufacturers accounting for 90% of U.S. auto sales, the United Auto Workers, environmental groups, state officials, and his administration to increase the average fuel economy of auto fleets to 54.5 mpg by 2025. When fully in place, the new standards will cut carbon pollution in half and reduce fuel consumption 40%. The cleaner engines, more efficient transmission systems, lighter materials, and more aerodynamic designs required to meet the goal will create 150,000 American jobs, reduce our oil use by more than three million barrels a day, and save Americans $80 billion a year at the pump.-Back to Work by Bill Clinton.

2005: The Energy Policy Act of 2005; Congress agreed in effect to insure the nuclear industry against losses in building new power plants, since no private insurance company will issue policies to do so.-Back to Work by Clinton.

1993-2001: The Clinton Administration

During my administration we had four surplus budgets and began to pay down the national debt; we eliminated sixteen thousand pages of federal regulations; we cut taxes on the middle class, working families of modest means, and income from capital gains; we reduced welfare rolls by almost 60 percent; we reduced the size of the federal workforce to its lowest level since 1960, when Dwight Eisenhower was president, and the smallest percentage of the overall workforce since 1933; and the economy produced more jobs (92 percent in the private sector, the largest percentage in fifty years) and moved a hundred times more people out of poverty than in the Reagan years (7.7 million versus 77,000).-Back to Work by Clinton.

1990: The PAYGO rule is passed which required Congress to fund new programs either by cutting other spending or by raising revenue.-Back to Work by Bill Clinton.

The PAYGO rule, which had done so much to ensure fiscal discipline, was scrapped, allowing the administration and Congress to enact both big tax cuts and big increases in spending on wars in Iraq and Afghanistan, on a new prescription drug benefit for seniors, on education through the No Child Left Behind Act, and on the world’s fight against AIDS and malaria through PEPFAR. We did all this on borrowed money, increasingly from overseas, with China, Japan, the United Kingdom, Saudi Arabia, and South Korea buying the bulk of our bonds. Foreign governments now hold more of our debt than Americans do. China has more than 25% of the foreign holdings, at $1.2 trillion, with Japan not far behind at $900 billion.-Back to Work by Bill Clinton.

_________________________________________________________