Basics- Real Estate

___________________________________________________________________________________

Buying a Home

Calculate what you can afford.

Ideally, your mortgage should not be more than 28% of your Gross Monthly Income, i.e if you make $3000/month, your mortgage should not be over $1000.

Understand the hidden costs of Real Estate.

i.e.: $150,000 home with 10% down.

Base monthly mortgage: $855, Property Tax (1-3% of home), monthly: $156, Monthly Homeowners Insurance: $38, Monthly PMI: $65, Home repairs: $125; TOTAL= $1239.

Principal: Amount Borrowed from the lender.

Interest: Amount Paid to the lender for allowing the money to be borrowed.

Property Tax: Amount due to the government for the privilege of private ownership of Real Estate.

Insurance: Amount paid to the insurance company in case of damage to the property.

Private Mortgage Insurance (PMI): Insurance paid by homeowners who pay <20% of the total mortgage.

Determine the following

Location

Type of House

Cooperative (COOP): Owned by the coop and leased long-term to the owner who makes monthly rental payments, taxes, insurance, management fees, etc to the COOP.

Condominium (Condo): Owned in full by an individual (FEE SIMPLE) who makes all payments.

Common Elements: Owned as ‘Tenants in Common’ and paid for using HOA fees.

Bedrooms (BR)/Bathrooms (BA)

Amenities (Patio, Pool, Fireplace, View, etc)

Size (measured in SqFt)

Contact a Real Estate Agent

In most cases, the Realtor is paid by the seller. They will help you research, conduct walk-throughs, and deal with the seller on your behalf. Do not be timid to reach out to them for assistance. Provide them with your cost, home type, location, size, amenities, BR/BA, etc.

Request a mortgage quote to obtain home loan from multiple lenders including your banks: finder, bankrate

Pay careful attention to your interest rate.

Ensure you have a percentage of the home cost for a down payment.

Down Payment: What you put down on the house (~20%); if your down payment <20%, in most cases you will have to pay PMI.

Order and attend a home inspection (your realtor can assist you with this).

Ask the inspector for a written assessment of all issues.

Order a Home Appraisal (your realtor can assist you with this).

Consider purchasing title insurance.

Obtain a detailed list of closing costs from your realtor.

Closing costs: 2-3% of mortgage to get deal done.

Conduct a final walk-through: Test all circuits, outlets, toilets, water sources, appliances, heating, AC, etc.

Sign the contract.

Take the Title to your home.

Title: Right to ownership of the land; title insurance covers you against an unclean title.

Move in.

___________________________________________________________________________________

Selling a Home

Use an Agent: The median home price for sellers who use an agent is 16% higher than homes sold by an owner.

___________________________________________________________________________________

Renting a Home

Establish a separate bank checking account to handle the income and the expenses.

___________________________________________________________________________________

Real Estate Taxes

Interest payments on your mortgage and property taxes are tax deductible.

According to current tax law, you can have a gain of $250K if you’re single or $500K if you’re married and pay zero taxes on the sale of your personal residence if you’ve lived there at least 2y.

If you rent your home, the IRS considers your rental property as a business and gives you several deductions. One is the payment you make on the interest of your debt service. In addition, there are the phantom deductions- the passive loss from component depreciation and from building depreciation, which are computed at an annual rate.

___________________________________________________________________________________

Real Estate Investing

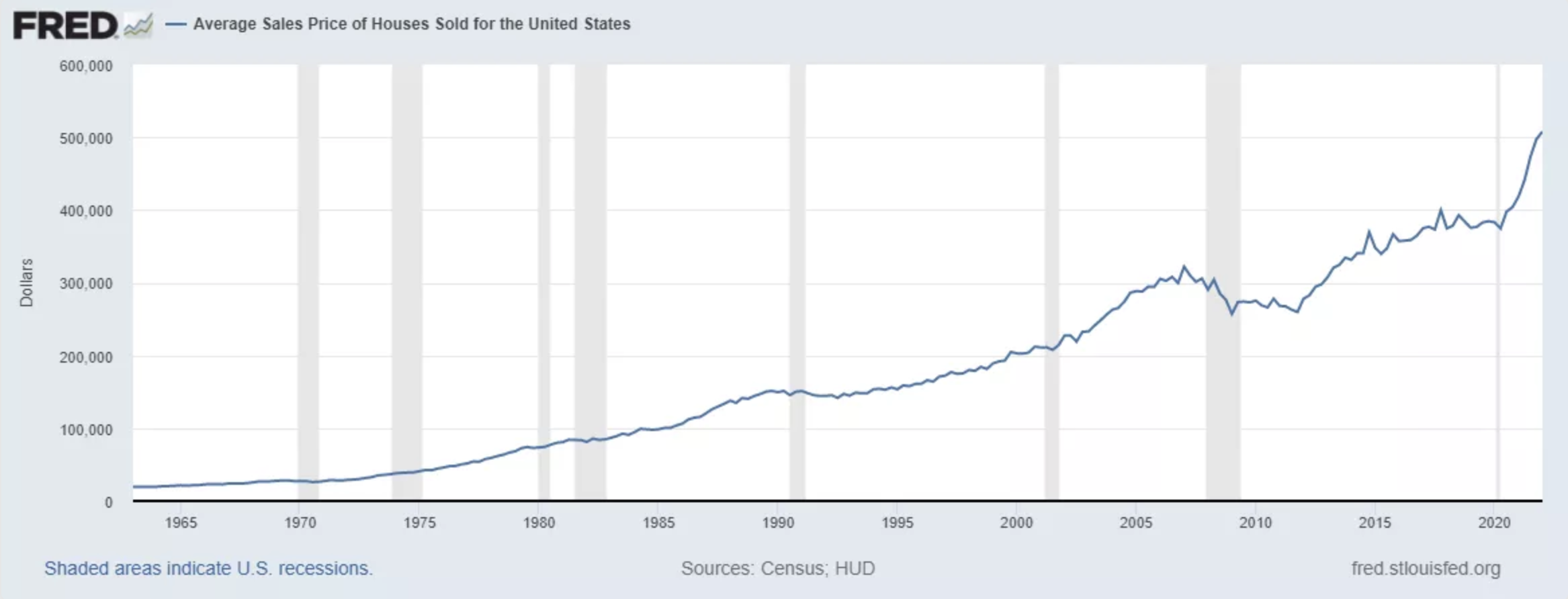

“A good house on good land keeps its value no matter what happens to money. As long as the world's population continues to grow, the demand for real estate will be among the most dependable inflation hedges available.”

“In the US, overall appreciation over the past 4 decades has been above 6% annualized.”

In a RE investment, there are 4 types of property: land, land improvements, personal property, and the structure of buildings.

A single member LLC is the best way to hold RE.

___________________________________________________________________________________

---Real Estate Law---

___________________________________________________________________________________

Home Ownership Law

Home Ownership Types

Fee Estate (‘Fee Simple Absolute’): Absolute ownership for an indefinite period of time.

Fee Simple Determinable (D, D, A): “For X years to A.”

Fee Simple Subject to Conditions Subsequent: “To A but if X event occurs.”

Fee Simple Subject to Executory Interest (Shifting Executory Interest): “To A, but if X happens, then to C.”

Life Estate: “To A for the life of A”; the Homeowner (Title Holder) grants possession of the property to a tenant for their life. The lifetime tenant is responsible for taxes and repairs. On death of the tenant, possession of the house reverts back to the title holder.

Life Tenants must not commit waste but are allowed to profit and even sell their interest.

Estates at Will: Owner allows tenant to use the property for free; estates at will terminate at the will of the fee owner once he or she has given the tenant proper notice.

Leasehold Estates: The typical landlord-tenant agreement; the owner grants a tenant the right to possess the property for a predetermined amount of time. The owner retains the title while the tenant possesses and use the property for the term of the lease.

Fixed Term Tenancy: A lease.

Periodic Tenancy: A rental.

Shared Home Ownership

Joint Tenancy (A, NOT D or D): Form of shared property ownership, used most commonly by married couples. Allow for undivided ownership, meaning each tenant owns the entire property and is granted all rights to use and occupy the property.

When one joint tenant dies, their share goes automatically to the surviving joint tenants.

Joint Tenants must take their interest at the same time and on the same title (same instrument) and with identical shares and with the right to possess the whole.

Joint Tenants without the Right of Survivorship (JTWROS): A form of shared property ownership in which buyers are tenants in common and tenants can pass their share without consent.

Tenancies in Common: Most common form of shared property ownership. Partners owns a separate fractional interest in the property with no right of survivorship. Each co-tenant owns an individual part and each has a right to possess the whole. Property is alienable, devisable, and descendible.

Each co-tenant is entitled to possess and use the whole property regardless of what percentage they own. Each is responsible for taxes, mortgage, etc based on their percentage of ownership.

Wrongful Ouster: Not allowing a joint tenant use of the whole.

Action for an Accounting: A co-tenant who leases part of a premise to a third party must account the rental income to each co-tenant according to their individual share percentage.

Adverse Possession: A single owner cannot acquire title to the exclusion of the others.

Right to Contribution: Co-tenants can make reasonable, necessary repairs provided they have told the other co-tenants; costs are split by undivided share percentage.

Improvements: During the life of co-tenancy there is no right to contribution for “improvements.

Improvements are inherently subjective.

At partition, the improving co-tenant is entitled to a credit equal to any increase in value caused, however the improver bears full liability for any drop in value caused.

___________________________________________________________________________________

Rental (Leaseholds) Law

Periodic Tenancy: ‘E conveys to M from week to week or month to month until E gives proper notice to terminate.’ Proper notice is generally equal to the period itself, unless otherwise agreed (only 6m for a yr-yr lease).

Term of Years: A lease for ANY fixed period of time (i.e. 1 day, 50y)

The tenant MUST know the termination date from the start.

Tenancy at Will: ‘E conveys to M’ with no fixed duration and terminable at the will of either party, however a reasonable demand to vacate is generally required. Treated as ‘Implied Periodic Tenancy’ unless Tenancy at will is expressly agreed to.

Duties of the Tenants (T) & Landlords (L)

Tenant (T)

Maintenance: T must maintain premises and make routine repairs other than those due to ordinary wear and tear.

T is liable to third parties T invited even where L promised to make the repairs.

T must not commit waste (which includes removing a fixture).

T must pay rent.

Landlord (L)

L must grant T possession and control common areas.

L has a duty to inspect, they must meet the requirements for duty of care, carry enough insurance to cover unforeseen claims, and have further protection with the proper legal entity.

L has a duty to disclose dangerous conditions. They MUST warn T of current problems.

A reasonable inspection is required every time L renews, extends, or first enters into a rental agreement. Negligence in inspecting the premises at such times leaves L vulnerable later on to being charged with foreknowledge of an unsafe condition that L should have found during the inspection.

Implicit Covenant of Quiet Enjoyment: T has right to quiet enjoyment of premises w/o interference from L.

Implied Warranty of Habitability: Premises must be fit for basic human dwelling. If unfit, T can make appropriate changes and deduct cost from rent; L must allow this.

Latent Defects: L must warn T of hidden defects that L knows about or should know about- merely a duty to warn, not to repair.

Rental Issues

If T breaches the duty to pay rent and is still in possession of the property, L’s only options is to evict through courts. L must not engage in self-help; changing locks, removing T’s possessions, forcibly removing T.

Tenancy at Sufferance: Occurs when a tenant has wrongfully held over past their period of tenancy; allows the landlord to recover rent and lasts until the tenant is evicted.

Retaliatory Conviction: If T lawfully reports L for housing code violations, L cannot end lease, raise rent, harass T, or take other reprisals.

___________________________________________________________________________________

Misc Quotes

“I always make an offer with language that details “subject-to” contingencies, such as the approval of a business partner. I never specify who the business partner is. Most people don’t know that my partner is my cat.”-Robert Kiyosaki.

___________________________________________________________________________________

Terminology

Alienable (A): Property that is transferrable.

Building items: include the structure and the components such as those that relate to the operation and maintenance of a building, such as ceilings and roofs, walls and windows, electrical and plumbing, central AC and heating systems, chimneys and bathtubs, sinks and lighting fixtures, fire escapes and stairs, floors and doors, landscaping and paving. Without a cost segregation, the value of these items is depreciated over 27.5 years in a residential rental property, and over 39 years in a nonresidential, or commercial real property.

Descendible (D): Property that is capable of passing without a will.

Devisable (D): Property that is capable of passing by will.

Fixture: Furnace, custom storm windows, heating systems, certain lighting installations. Fixtures pass with ownership of the land.

Homestead Exemption: FL Law; protects against seizure, forced sale, creditor claims, credit card balances, accidents, etc.

Partition: Breakup of a relationship.

Partition in Kind: Court Action for the physical division of property if in the best interest of all.

Personal Property Items: Items that can be removed without damage or disablement to the structure or its operation and maintenance. In general, personal property in residential rental properties falls into either 5y or 7y schedules for depreciation.

Pro Forma: Contains the property's sale price and operating costs, such as utilities and taxes, insurance, repairs, and business expenses; and it projects the property value and income based on such market factors as a full occupancy rate.

Securitization: Investors pool money in a trust. The trust money is given to a bank to loan to home buyers as mortgages. The Mortgages are packed together and the trust receives a monthly payment.

Severance: Breakup plan/dissolution plan.

Voluntary Agreement: Peaceful resolution.

Waste: Anything that is destructive to property and/or hurts future interest holders. There are 3 types of waste.

Voluntary (Affirmative): Waste due to overt conduct that causes a drop in value; includes the removal of fixtures; allowed for PURGE- Prior use allowed waste, Repairs and maintenance, Granted by right, Exploitation of land is allowed.

Permissive Waste (Neglect): Land falls into disrepair. Tenants must, at least, maintain the premises.

Ameliorative Waste: Life Tenant must not engage in acts that will enhance the property’s value unless all future interest holders accept.

___________________________________________________________________________________