Fundamentals by Wilczek

Ref: Frank Wilczek (2021). Fundamentals; Ten Keys to Reality. Penguin.

_____________________________________________________________________________________

Summary

This is a book about fundamental lessons we can learn from the study of the physical world.

I’ve tried to convey the central messages of modern physics as simply as possible, while not compromising accuracy.

Fundamentals is meant to offer an alternative to traditional religious fundamentalism. It takes up some of the same basic questions, but addresses them by consulting physical reality, rather than texts or traditions.

_____________________________________________________________________________________

1 THERE’S PLENTY OF SPACE

Events are located in both space and time. The geometry of events must be constructed within that larger framework: space-time, not just space. In general relativity, we learn further that the geometry of space-time can be warped by the influence of matter, or by waves of distortion that travel through it.

Hubble discovered a strikingly simple pattern within the redshifts he observed: The farther the galaxy, the larger the redshift.

The wavelengths involved in visible light are approximately half of one-millionth of a meter, so microscopes based on imaging visible light get fuzzy below that distance.

An atomic nucleus contains more than 99% of the atom’s mass. Yet a nucleus extends less than one-hundred-thousandth of its atom’s radius and—being nearly spherical—occupies less than one part in a million of one part in a billion of its volume.

Milky Way Galaxy: A fairly flat disc with a bulge in the middle; ~300K light-years across.

Typical separation between galaxies is not vastly larger than the galaxies themselves.

Proxima Centauri: Earth’s closest star; ~4 light-years away.

Barnard’s Star: ~6 light-years away.

In the Sun, a chain of reactions results in the conversion of four H atoms into one He atom plus two neutrinos, releasing energy.

Venus is closer to the Sun than is Earth, but if we put it at Earth’s orbit, its temperature would still be alarmingly high—about 340°C (645°F).

_____________________________________________________________________________________

2 THERE’S PLENTY OF TIME

Two approaches to measuring very long times: Radioactive Dating and Stellar Astrophysics.

Carbon Dating: New 14C nuclei are being created in Earth’s atmosphere, through the action of cosmic rays. That creation compensates for the decays and maintains a balance between 14C versus 12C in the atmosphere. Living things take in C either directly from the atmosphere or shortly after it dissolves from the atmosphere into water. The C they ingest reflects the current atmospheric 14C/12C balance. But once it is incorporated into their bodies, the decaying 14C is no longer replenished. After that its fraction decreases with time, in a predictable way. Thus, by measuring the ratio of 14C to 12C in a sample of biological origin, one can determine when the source of the sample was last alive and capturing C. Since there are always far more 12C nuclei than 14C, we can get a good estimate of 12C abundance simply by weighing the total carbon. To get the 14C abundance, we can measure the radioactivity— that is, the rate of electron emission. Since we know what proportion of 14C decays in an interval of time, we can leverage that measurement to infer the 14C content. A more modern method is to take the sample to an accelerator, where you can physically separate the 14C and 12C, by exploiting their different motions in strong electric and magnetic fields. The two methods yield consistent results.

Carbon- 12 (12C): The most common isotope of carbon with 6 protons and 6 neutrons. 12C nuclei are highly stable.

Carbon-14 (14C): A significant yet unstable isotope of Carbon with 6 protons and 8 neutrons. 14C has a half-life of about 5,730 years, decaying into N nuclei (14N) while emitting electrons and antineutrinos.

_____________________________________________________________________________________

3 THERE ARE VERY FEW INGREDIENTS

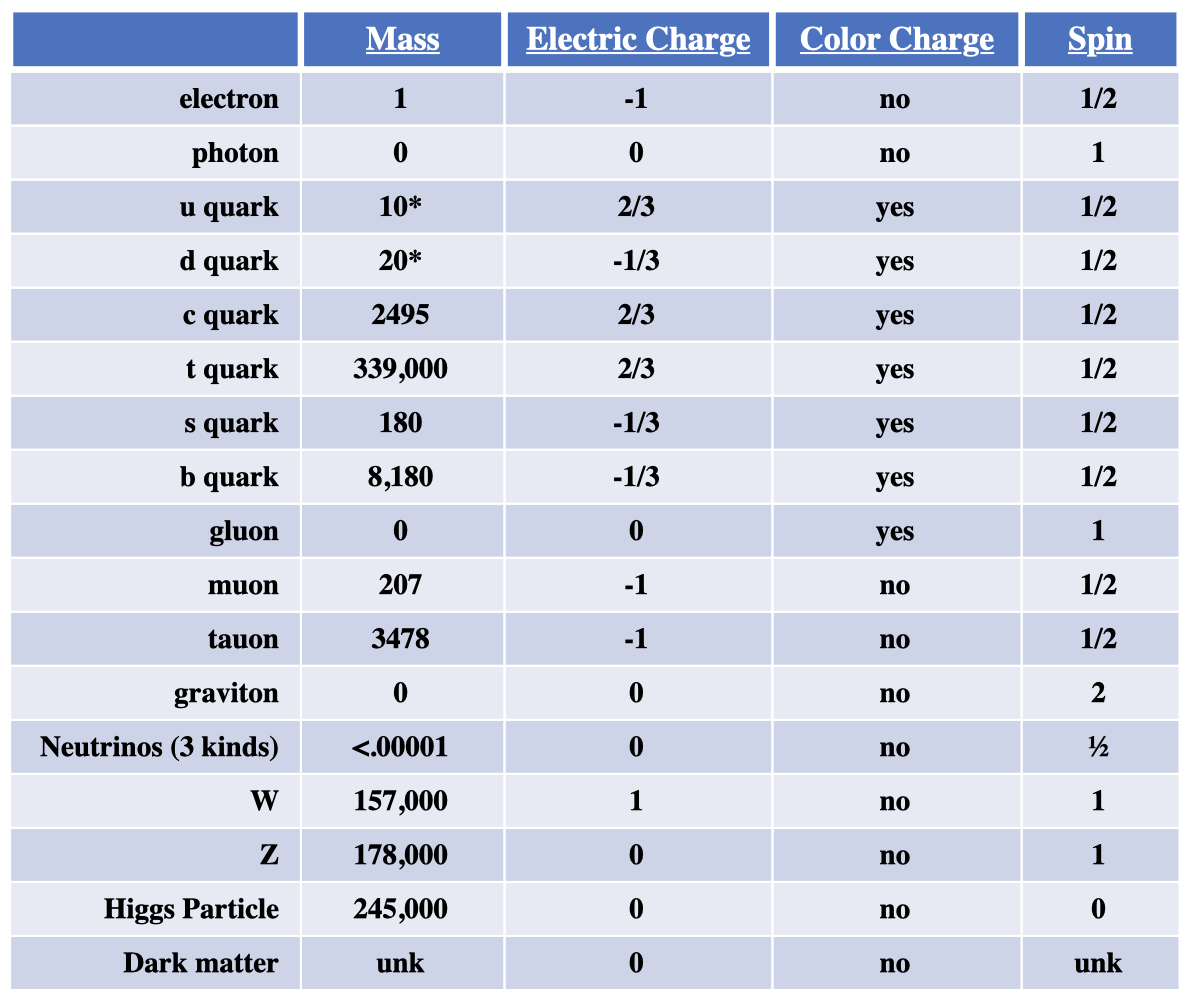

Electrons; photons; two kinds of quarks, commonly called “up” and “down” quarks; and gluons. Thus, we can construct the matter that we encounter in ordinary life, and that our bodies are built from, using exactly five kinds of elementary particles as ingredients.

According to our present best understanding, the primary properties of matter, from which all its other properties can be derived, are these three: Mass, Charge, and Spin. For any elementary particle, once you’ve specified the magnitude of those three things, together with its position and velocity, you’ve described it completely.

Each distinct kind of atom emits a distinct pattern of light, atomic spectra form a kind of signature, or fingerprint. Thus, simply by looking—and paying careful attention to color!—we can discern the identity and study the behavior of atoms that are far removed from us in space and time.

Spin: The basic idea of spin is that elementary particles are ideal, frictionless gyroscopes, which never run down.

A rapidly spinning gyro resists attempts to alter its axis of rotation. Unless you exert a large force, the orientation of that axis won’t change much. We say that the gyro has orientational inertia…The faster a gyro rotates, the more effectively it will resist attempts to change its orientation. By comparing the force with the response, you can define a quantity that measures orientational inertia. It is called angular momentum. Big gyros that rotate rapidly have large angular momentum, and show small responses to applied forces.

Elementary particles are tiny gyros, indeed. Their angular momentum is very small. When angular momentum gets as small as it does for elementary particles, we enter the domain of quantum physics. Quantum mechanics often reveals that quantities which were once thought to be continuously variable actually come in small discrete units, or quanta. So, it is for angular momentum. According to quantum mechanics, there is a theoretical minimum to the amount of angular momentum any object can carry. All possible angular momenta are whole-number multiples of that minimal unit.

Electrons, quarks, and several other kinds of elementary particles carry exactly the theoretical minimum unit of angular momentum. Physicists express that fact by saying that electrons, and the other examples, are particles with spin ½.

Planck argued that light was emitted and absorbed in lumps based on experiments measuring the glow from heated bodies (so-called blackbody radiation).

Our modern fundamental ingredients have no intrinsic size or shape. If we insist on visualizing them, we should think of structureless points where concentrations of mass, charge, and spin reside.

Particles are avatars of fields.

Superstring Theory: Postulates that our elementary particles are actually strings.

A body’s electric charge governs the strength of its response to electric and magnetic fields. There are two other kinds of charge, analogous in many ways to electric charge, that play a similar role in the other fundamental interactions. They are called color charge and weak charge. A body’s color charge governs the strength of its response to gluon fields…The unit of color charge, which governs the strength of the strong force, is bigger than the unit of electric charge.

Three different kinds of color charge, and eight different kinds of gluons that respond to them, as opposed to one kind of electric charge and one photon.

Consider what happens when a quark within a proton is suddenly jerked by an external force. The external force might come from a bombarding electron, for example. The quark, ripped from its normal environment, starts with a lot of energy and momentum, and leaves the proton. An isolated quark is an untenable situation, however. Its uncompensated color charge interferes with the equilibrium of the color gluon fields, and the quark thereby radiates gluons, shedding energy and momentum. Those secondary gluons will also radiate, either into other gluons or into quarks and antiquarks. In this way, the initial jerk leaves a trail of quarks, antiquarks, and gluons, which then congeal into protons, neutrons, and other hadrons. As always, the quarks, antiquarks, and gluons do not materialize as individual particles, but only within associations (hadrons).

Jet: Many particle tracks emerging within a narrow cone.

Atoms and Particles

Electrons: Negatively charged particles that generate tiny magnetic fields while spinning; bound to the nucleus by electrical attraction.

Gluons: Massless; bind together quarks, protons, and atomic nuclei.

Neutrons: Contain the quark combination udd bound by gluons (photon-like particles).

Photons: Massless; bind together atoms and molecules; electrically neutral. Photons carry energy, and thus that they have inertia and exert gravity, despite having zero mass.

Protons: Contain the quark combination uud bound by gluons (photon-like particles).

Quarks: Never found in isolation, but only within protons, neutrons and other strongly interacting particles (so-called hadrons). Quarks have very small masses.

While electrons always repel one another, quarks, because their color charges come in three varieties, feel more complex forces, which can be attractive. This possibility allows quarks, in contrast to electrons, to bind together without requiring a “nucleus” made of something else.

For quarks, the most important thing to note is that while their mass is large relative to electrons, it is very small relative to protons or neutrons.

C/T Quarks: Unstable versions of the u quark.

S/B Quarks: Unstable versions of the d quark.

Muon/Tauon: Heavier, unstable versions of the electron.

Graviton: The particle from which gravitational fields are made; bind planets, stars, galaxies, and big things in general. Gravitons have never been observed as individual particles, because their interactions with ordinary matter are far too feeble for that to be practical. What has been observed are gravitational forces—and, recently, gravitational waves. Theoretically, those observable effects arise from the cumulative action of many individual gravitons.

Bosons: W, Z, Higgs; are ~100x heavier than protons and highly unstable.

_____________________________________________________________________________________

4 THERE ARE VERY FEW LAWS

Law of Gravity (Newton): Bodies attract one another with a force that is proportional to the product of their masses and decreases as the square of the distance between them.

Law for Electric Forces (Coulomb): Like Charges repel, unlike charges attract. The size of electric force varies inversely as the square of the disturbance between two charges.

Law of Induction (Faraday): Magnetic fields that change in time produce circulating electric fields.

Law of Induction (Maxwell): Electric fields that change in time produce circulating magnetic fields (built on Faraday’s field concept).

When he married the two field-based induction laws—Faraday’s and his own—Maxwell discovered that they gave birth to a dramatic new effect. One could have a self-restoring, permanent, traveling disturbance in electric and magnetic fields. Changing electric fields induce changing magnetic fields induce changing electric fields induce changing magnetic fields.

Quantum Field: Reconciles the different aspects of light- the field and particle.

Planck’s Equation: E = hv (E: Energy, v: frequency, h: Planck’s constant).

Electron Field: All electrons have the same properties, because each is an excitation in the same universal field.

Relativity: E = mc2; expresses the energy latent in an object at rest, due to its mass. Energy, not mass, controls inertia.

Gravity will impart the same acceleration to any body that occupies a given position at a given time, regardless of the body’s properties.

Gravitational acceleration reflects a property of space-time.

Space time has curvature, which affects the motion of bodies moving in space-time.

Bodies that move “as straight as possible” might nevertheless fail to move in a straight line.

In space-time, a straight line represents motion at a constant velocity.

Deviation from straight-line motion, therefore, represents acceleration.

Gravity reflects space-time curvature.

Since curvature can vary from place to place, and in time, it defines a field.

Space-time curvature, which encodes gravity, should be proportional to mass.

All forms of energy, and not only mass-energy, exert gravity (a later refinement called the Cosmological Constant).

Inertia: Measures the resistance of a body to changes in its motion. Thus, a body that has large inertia will tend to keep moving at its present velocity unless it is subjected to large forces.

A moving particle has more inertia, and exerts more gravity, than a particle at rest.

Gravity: The attraction a particle exerts on other particles. The larger the mass of a particle, the larger its gravity.

Some of the most important particles, including photons, gluons, and gravitons, have zero mass. This does not mean that they have no inertia, or that they exert no gravity. In fact, they do.

For bodies at rest, energy and mass are proportional, according to Einstein’s famous formula E = mc2.

Fundamental Forces: Gravity keeps Earth in orbit around the Sun, at a nice distance, where the equilibrium temperature supports dynamic complexity. The electromagnetic force, QED, weaves atoms into molecules. The strong force, QCD, supplies the attractions that make nuclear burning possible. The weak force enables the transformations that allow nuclear burning to proceed, but only slowly.

From forces we are led to fields, and from (quantum) fields, we are led to particles. From particles we are led to (quantum) fields, and from fields, we are led to forces.

Physicists often speak of the four “interactions,” as opposed to the four “forces.”

Our laws for the four fundamental forces, taken together, comprise what is sometimes called the “Standard Model” or (my preference) “the Core.”

Asymptotic Freedom: The weakening of the strong force at short distances. We find that at extremely short distances, unification is achieved. The strengths of all four forces become equal.

Weak Nuclear Force: Governs processes of transformation, causing particles to decay. The weak force supplies a kind of cosmic storage battery, allowing for the slow release of cosmic energy. The force acts upon quarks wherever they are.

Neutron Decay: The conversion of a neutron into a proton, an electron, and an antineutrino, with release of energy. Isolated neutrons decay with a half-life of ~10minutes. In the atomic nucleus, the proton remains while the electron and anti-neutrino escape.

Strong Nuclear Force: Holds atomic nuclei together and governs their structure. The strong force is controlled by color charge, much stronger than electromagnetic forces, which are controlled by electric charge. This is why atomic nuclei, which are bound together tightly by the strong force, are much smaller than atoms.

Quantum Chromodynamics (QCD): A system of equations that govern the strong force.

Electrical repulsion among the protons in an atomic nucleus wants to blow it apart, and gravity is far too weak. People called this new force the strong force.

Electromagnetism (Quantum Electromagnetism- QED): Holds atoms together and governs their structure. It also describes how they interact with light.

Gravity.

_____________________________________________________________________________________

5 THERE’S PLENTY OF MATTER AND ENERGY

A typical human adult takes in about 2,000 cal/day, enough energy to run a 100 W light bulb continuously. Over a year, it amounts to 3B joules (1J = 1W/1sec). Of that amount, ~20% is used to support brain activity.

Here on Earth, through most of biological and human history, the physical realization of dynamic complexity has hinged upon making and breaking enormous numbers of chemical bonds, using power supplied by the Sun.

Combinatorial Explosion: The rapid growth in the number of overall possibilities as you make several independent choices.

In DNA, we get to make four choices among nucleotides (guanine, adenine, thymine, cytosine—G, A, T, C) to attach at each spot along a long sugar–phosphate backbone, and there can be many thousands of spots. Proteins, similarly, involve choosing among 20 amino acids attached to stereotyped backbones of variable length. Those architectures support combinatorial explosions of precisely the same type as the decimal expansion of numbers, but in base 4 or base 20.

Each neuron is an impressive little information-processing device. Individual neurons are wired together through many connections. Typical neurons can make hundreds or even a few thousand connections to other neurons. Much of what we learn is encoded in the varying strength of these connections, as useful patterns of influence get reinforced and useless ones whittled away. Peak connectivity occurs between the ages of two and three, but peak complexity occurs later, after a lot of selective whittling.

To thrive, human bodies require specific conditions, including temperatures within a narrow range, air that contains a special mix of molecules and is free of toxins, a reliable supply of water and nutrients, and protection from UV radiation and cosmic rays.

_____________________________________________________________________________________

6 COSMIC HISTORY IS AN OPEN BOOK

Basic Ingredients of Physical Reality: Space, time, fields, laws, and dynamic complexity.

Hubble discovered that distant galaxies are moving away from us, with velocities proportional to their distances.

In thermal equilibrium at extremely high temperatures, we find a completely predictable mixture of all the elementary particles.

Big Bang

Cosmic Microwave Background (CMB): A lingering afterglow of photons that fills the universe from the Big Bang. Those photons have been drastically redshifted, and now they are primarily microwave radiation.

The overwhelming majority of potential nuclear material emerges from the big bang as ordinary H (1H—a lone proton) and He (4He—two protons and two neutrons). There are also small admixtures of deuterium (2H—one proton and one neutron, an isotope of hydrogen), He 3 (3He—two protons and one neutron, an isotope of helium), and Li (7Li—three protons and four neutrons). All other kinds of nuclei got formed in stellar processes, at a much later stage in cosmic history.

_____________________________________________________________________________________

7 COMPLEXITY EMERGES

Dense regions in the universe exert more powerful attractions, and thus accumulate more matter, and thus become still denser. Regions that are less dense than average, conversely, will lose to the competition, and empty out further.

Gravitational Instability: Small contrasts evolve into larger ones.

If the total density of matter is equal to a certain critical density, then space will be flat; if the density is larger, it will be positively curved, like a sphere; if the density is smaller, it will be negatively curved, like a saddle.

We find roughly the same density of galaxies in all directions, and at all distances.

At present, the critical density is about 10e-29 g/cm3; equivalent to the mass of ~6x H atoms per m3, close to the average density of the universe as a whole.

Space is very nearly flat.

According to Einstein’s general theory of relativity, space is a kind of material. It is a dynamic entity, which can bend and move…Upon combining general relativity with quantum mechanics, we calculate that space is a kind of quivering Jell-O, in constant motion.

In gravitational waves, bending of space-time in some directions causes bending in others.

_____________________________________________________________________________________

8 THERE’S PLENTY MORE TO SEE

Smell: Dogs’ noses contain some 300M receptors, compared to 6M for humans. And a large portion—about 20%—of a dog’s brain processes the result, compared with <1% for humans.

Sound: Bats navigate in the absence of light by sending out extremely high-pitched sounds—ultrasound—and analyzing the (ultra)sounds that bounce back. Human ears are deaf to ultrasound. They cannot be used for fine navigation, because the wavelength of humanly audible sound is too large. People have a poor sense of where the sounds they hear originate, in general.

Vision: Our vision samples only the radiation that strikes our pupils. They are sensitive only to visible light- radiation within a narrow range, from about 350 to 700 nM (~half a millionth of a meter, or a few hundred-thousandths of an inch). We have three different kinds of cone cells, broadly tuned to different wavelength ranges, involved in color vision, plus rod cells, also broadly tuned, that kick in for peripheral and night vision. Birds have a better spectral analysis of visible light. Their receptor cells contain oil droplets that selectively filter different wavelength ranges.

_____________________________________________________________________________________

9 MYSTERIES REMAIN

Dark matter and dark energy have a similar character, so it makes sense to introduce them together. They both refer to observed motions that have no apparent cause. It would be more accurate, if less evocative, to say we have “unexplained accelerations,” rather than “dark matter” and “dark energy.” But the extra motions are all of a pattern, which suggests that they are caused by gravity from sources that are otherwise invisible.

Time Reversal Symmetry (T): The laws you need to predict past states, given present states, are the same laws that you use to predict future states

1964: James Cronin, Val Fitch, and their collaborators discover a tiny, obscure effect in the decays of K mesons that violates Time Reversal Symmetry (T). Nine years later in 1973, Makoto Kobayashi and Toshihide Maskawa made a theoretical breakthrough on this problem. They built upon the imposing framework of quantum field theory and the Core theories of the forces (which at the time were not yet firmly in place), discovering that by adding a third family of quarks and leptons* to the two that were then known, you have the possibility of introducing an interaction that violates T and generates the effect that Cronin and Fitch observed. With only the two known families, there was no such possibility.

Dark Matter: Possible composed of axions, left over from the lingering afterglow from the Big Bang, that interacts feebly with ordinary matter.

From the observed rotation speeds, you can infer how mass is distributed within a galaxy of interest. What people find is that to explain the observed speeds, you need lots of mass in places where there isn’t much light being emitted. It seems, in essentially all cases that have been studied, that the galaxy is surrounded by an extended halo of dark (invisible) matter. Indeed, it would be more appropriate to say that the lit-up part of the galaxy is an impurity within a cloud of dark matter. The dark matter halo, when you add it all up, weighs about six times more than the visible impurity.

What is surprising is the size of the effect. Here again, astronomers find that they need the galaxies in the cluster to weigh about six times what the visible stars and gas clouds supply. These and other observations suggest that dark matter provides about 25% of the mass in the universe. “Normal” matter—the kind that we understand and are made of—provides about 4%. Most of the rest is dark energy.

Dark Energy: Possibly a universal density of space itself.

A volume of space equal to the Earth’s volume weighs about 7 mg…such is the vast emptiness of intergalactic space that this small density, present everywhere, comes to dominate the total mass of the universe.

Dark energy presently accounts for about 70% of the universe’s mass; representing a universal density of space itself, and that it is associated with a universal negative pressure.

Gravitational Lensing: The bending of light due to gravity.

Cosmological Constant: Posits that space-time itself might also have inertia, which can impact space-time.

_____________________________________________________________________________________

10 COMPLEMENTARITY IS MIND-EXPANDING

Complementarity: The concept that one single thing, when considered from different perspectives, can seem to have very different or even contradictory properties.

In quantum mechanics, the most basic description of an object—whether the object is an electron or an elephant—is its wave function….Two ways of processing the wave function are broadly similar to two ways of analyzing music, by harmony or by melody. Harmony is like position, while melody is like velocity.

Facts can’t falsify other facts. Rather, they reflect different ways of processing reality.

Free will and physical determinism are complementary aspects of reality.

_____________________________________________________________________________________

Misc Quotes

“We will never again understand nature as well as Greek philosophers did…We know too much.”

“The fact that [the universe] is comprehensible is a miracle.”-Albert Einstein.

“If, in some cataclysm, all of scientific knowledge were to be destroyed, and only one sentence passed on to the next generations of creatures, what statement would contain the most information in the fewest words? I believe it is the atomic hypothesis (or the atomic fact, or whatever you wish to call it) that all things are made of atoms.”-Richard Feynman.

“The work will teach you how to do it.”-Anonymous.

“Everything should be made as simple as possible, but no simpler.”-Einstein.

“I consider that I understand an equation when I can predict the properties of its solutions, without actually solving it.”-Paul Dirac.

“The most beautiful thing we can experience is the mysterious. It is the source of all true art and science. He to whom the emotion is a stranger, who can no longer pause to wonder and stand wrapped in awe, is as good as dead—his eyes are closed.”-Albert Einstein.

“The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.”-F. Scott Fitzgerald.

“Benjamin Franklin got to choose which kind of charge to call positive and which negative. He chose to call the charge that accumulates on glass, after it is rubbed with silk, positive. This was long before people knew about electrons. Unfortunately, it turns out that according to Franklin’s choice the electron’s charge is negative.”

“That attitude, which makes the perfect the enemy of the good, is superficially deep, but deeply superficial.”

“Times devouring flow.”

“Yesterday’s sensation is today’s calibration.”

“One cannot escape the feeling that these mathematical formulae have an independent existence and an intelligence of their own, that they are wiser than we are, wiser even than their discoverers, that we get more out of them than was originally put into them.”

“With the rise of agriculture, it became crucial to keep track of seasons, in order to plant and harvest at the most appropriate times.”

“A human being is part of a whole, called the Universe, a part limited in time and space. He experiences himself, his thoughts and feelings, as something separated from the rest, a kind of optical delusion of his consciousness. This delusion is a kind of prison for us, restricting us to our personal desires and to affection for a few persons nearest us. Our task must be to free ourselves from this prison by widening our circles of compassion to embrace all living creatures and the whole of nature in its beauty.”-Einstein.

“Science tells us many important things about how things are, but it does not pronounce how things should be, nor forbid us from imagining things that are not. Science contains beautiful ideas, but it does not exhaust beauty. It offers a uniquely fruitful way to understand the physical world, but it is not a complete guide to life.”-Wilczek.

_____________________________________________________________________________________

Terminology

Atom: “Without Parts” (Greek).

Charge-Coupled Devices (CCDs): Count electrons liberated by photons and record the resulting numbers in arrays of 0s and 1s.

Cosmic Horizon: The distance that light has traveled since the time of the big bang.

Electron Volt: The energy required to break a typical chemical bond.

Equinoxes: Mark the equal divisions of day and night.

Fields: The fundamental building blocks of matter in modern physics.

Gamma Rays: High-energy photons.

Interferometry: Allows you to compare the lengths of light paths to within a fraction of a wavelength.

Laws: Describe “how things change.”

Planck Length: ~10e-33 cm; at this length, typical fluctuations in the distance between two points can be as large or larger than the distance itself.

Quantum Computing: Using the direction of electron spins—up or down—instead of the electrons’ concentration, to embody 0 and 1.

Scanning Microscopy: One holds a needle with a tiny tip close to a surface of interest and “scans” by moving the tip parallel to the surface. If one does this while applying an electric field, then electric currents flow from the surface into the needle. The nearer the tip is to the surface, the larger the current. In this way, one can read out the topography of the surface with subatomic resolution. In images that reflect this data, one sees individual atoms towering up like mountains above a flat landscape.

Solstices: Mark the extreme divisions of day and night.

Spectrum: The array of colors that an atom emits. The study of spectra is called spectroscopy.

States: Describe “what there is.”

Uncertainty Principle: Position and velocity could not be measured simultaneously (Werner Heisenberg).

X-Ray Diffraction: Shine an x-ray beam on the object of interest, let the object bend and scatter the beam, and record what comes out.

_____________________________________________________________________________________

Resources

Large Hadron Collider (LHC): When the LHC is operating, two narrow beams of protons traverse the tunnel in opposite directions within a pipe that threads it. Moving at nearly the speed of light, the protons make eleven thousand orbits per second. At four points the beams cross. Only a small fraction of the protons collide, but this still amounts to nearly a billion collisions per second. All that firepower produces the concentrations of energy it takes to make Higgs particles. The next task is to detect them. Enormous, densely instrumented detectors surround the crossing points. One of them, the ATLAS detector, is more than twice as large as the Parthenon. The detectors track the energies, charges, and masses of the particles that emerge from the collisions, as well as their directions of motion. They feed all this information, at the rate of 25M GB per year, to a worldwide grid that links thousands of supercomputers. All that information gathering is necessary because: The events are complicated. Typically, ten or more particles stream out from each one. Few of the events—less than one in a billion—ever contained Higgs particles. Those events that do contain them, don’t contain them for long. The lifetime of a Higgs particle is about 10e-22 seconds, or a tenth of a trillionth of a billionth of a second; https://home.cern/science/accelerators/large-hadron-collider.

Laser Interferometer Gravitational-Wave Observatory’s (LIGO): Built to detect and observe gravitational waves. LIGO is an exquisite instrument, designed to detect tiny distortions in space-time. It is sensitive to changes in the relative positions of mirrors, separated by 4km, that are ~1000x smaller than the size of an atomic nucleus: https://www.ligo.caltech.edu/.

Particle Data Group: Chronicles and documents the empirical evidence for our fundamental understanding of cosmology and of matter and its interactions in full technical detail: http://pdg.lbl.gov.

_____________________________________________________________________________________

Chronology

17 Aug, 2017: Gravitational waves are detected, matching predictions from the merger of two neuron stars.-Fundamentals by Wilczek.

18 Sep, 2015: Scientists first detect gravitational waves released from the burst of radiation from a merger of two black holes, with masses roughly 20-30x that of our Sun, ~1.3 B light-years away.-Fundamentals by Wilczek.

4 Jul, 2012: Discovery of the Higgs particle.-Fundamentals by Wilczek.

1998: Astronomers discover dark energy, observing that the rate of expansion of the universe has been increasing, consistent with a universal negative pressure. This was inferred from measurements of redshifts, in the spirit of Hubble, but using supernovas in place of Cepheid variables.-Fundamentals by Wilczek.

1967: Rainer Weiss publishes his work on Gravity Waves, which forms the basic concept that eventually matures into LIGO.-Fundamentals by Wilczek.

1964: James Cronin, Val Fitch, and their collaborators discover a tiny, obscure effect in the decays of K mesons that violates Time Reversal Symmetry (T). Nine years later in 1973, Makoto Kobayashi and Toshihide Maskawa made a theoretical breakthrough on this problem. They built upon the imposing framework of quantum field theory and the Core theories of the forces (which at the time were not yet firmly in place), discovering that by adding a third family of quarks and leptons to the two that were then known, you have the possibility of introducing an interaction that violates T and generates the effect that Cronin and Fitch observed. With only the two known families, there was no such possibility.-Fundamentals by Wilczek.

1964: Arno Penzias and Robert Wilson detect the Cosmic background radiation, the lingering glow of photons present when the big bang first cooled enough to become transparent.-Fundamentals by Wilczek.

1936: The muon is discovered.-Fundamentals by Wilczek.

1931: Belgian Astronomist and Jesuit priest Georges Lemaître first proposes his interpretation of Hubble’s observations which he calls “the primeval atom” or the “cosmic egg” (Big-Bang came later).-Fundamentals by Wilczek.

1926: Paul Dirac introduces the specific quantum conditions that apply to electric and magnetic fields.-Fundamentals by Wilczek.

1925: Werner Heisenberg introduces the general idea of quantum conditions.-Fundamentals by Wilczek.

1925: The word “photon” is introduced by chemist Gilbert Lewis.-Fundamentals by Wilczek.

1917: Einstein modifies his theory of General Relativity (1915) to allow for the cosmological constant (that space time itself has inertia).-Fundamentals by Wilczek.

1913: Hans Geiger and Ernest Marsden, with Rutherford guiding the effort, first attempt to look inside atoms, bombarding gold with alpha particles. Rutherford’s detailed analysis of the Geiger-Marsden observations gave birth to the modern picture of atoms, showing that 99% of the mass and all of the positive charge is concentrated in a tiny nucleus.-Fundamentals by Wilczek.

“It was quite the most incredible event that has ever happened to me in my life. It was almost as incredible as if you fired a 15-inch shell at a piece of tissue paper and it came back and hit you. On consideration, I realized that this scattering backward must be the result of a single collision, and when I made calculations, I saw that it was impossible to get anything of that order of magnitude unless you took a system in which the greater part of the mass of the atom was concentrated in a minute nucleus. It was then that I had the idea of an atom with a minute massive centre, carrying a charge.”-Rutherford.

1905: Einstein’s “Miracle Year”; Einstein postulates special relativity, the existence of atoms (Brownian motions), and E = mc2.-Fundamentals by Wilczek.

1905: The Planck-Einstein formula; Einstein builds on Planck’s 1900 equation (E = hv) to predict the existence of photons.-Fundamentals by Wilczek.

1900: Planck proposes his famous equation, E = hv (E: Energy, v: frequency, h: Planck’s constant).-Fundamentals by Wilczek.

1897: Electrons are first identified by JJ Thompson.-Fundamentals by Wilczek.

1846: Le Verrier postulates the existence of a planet between Mercury and the Sun which he names Vulcan.-Fundamentals by Wilczek.

1842: Christian Doppler first points out that if a source of waves is moving away from us, then successive peaks in the wave pattern it emits will will arrive stretched out; the observed waves will be shifted toward longer wavelengths than if they had come from a stationary source.-Fundamentals by Wilczek.

1687: Newton pens Principia.-Fundamentals by Wilczek.

~13 Ga: Star and planet formation commences.-Fundamentals by Wilczek.

Big Bang + 380K: The fireball of the Big Bang first cools down enough to become transparent, releasing the photons that comprise the so-called Cosmic Background Radiation.-Fundamentals by Wilczek.

13.8 Ga: The Big Bang.-Fundamentals by Wilczek.

> 13.8 Ga: Time doesn’t exist; there is no space.-Fundamentals by Wilczek.

_____________________________________________________________________________________