Investment Answer by Murray and Goldie

Ref: Murray & Goldie (2011). The Investment Answer. Hatchett Books.

_________________________________________________________________________

Summary

An overview of the Stock Market, Investment Vehicles, active and passive management, and irrational market behaviors to help you invest with an appropriate, personal, and acceptable level of risk.

_________________________________________________________________________

Risk

Risk: the uncertainty of future result.

Credit Risk: the risk that a company’s credit quality could wane and you, as a bondholder or creditor, could lose some or all of your investment.

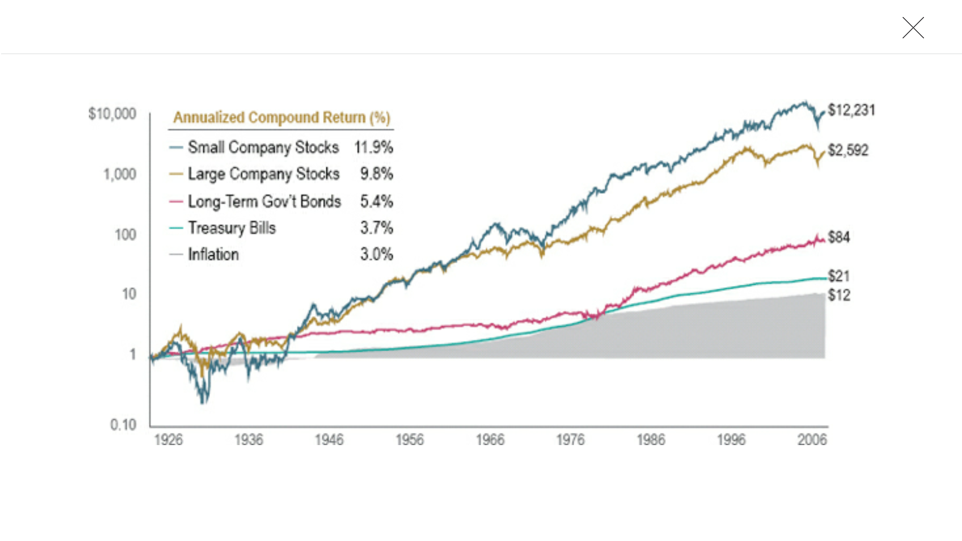

Inflation Risk: your portfolio’s real return (the return you get after deducting inflation) can be much less than its nominal (pre-inflation) return, especially over longer time periods. This is one of the most significant risks for long-term investors.

Maturity Risk: longer-term bonds have more risk (and price volatility) than shorter-term bonds. After all, if you lend me money for ten years, isn’t that a riskier proposition than if you lend it to me for only one month?

Market Risk: this is the non-diversifiable risk inherent in any securities market. If you own a stock, the largest element of risk you are taking is that the stock market as a whole might go down. If it does, the market will likely take your stock down with it.

_________________________________________________________________________

Irrational Market Behavior

Overconfidence

Biased judgments

When the prices of most consumer goods such as gasoline or beef rise, people tend to either cut back or find a substitute. However, with financial assets the opposite seems true. Many investors are more attracted to a stock whose price has risen than one whose price has fallen because we incorrectly extrapolate past price changes into the future.

Herd mentality

Loss aversion

Myopic Loss aversion afflicts most investors, making them focus on the short term. However, a lot of short-term information is irrelevant in the long term. If you’ve bought solid companies, the best advice is often “don’t just do something, sit there.”

_________________________________________________________________________

Investment Types

Equities (Stocks): an ownership interest in a company.

Bonds (Fixed Income): an IOU or a loan to a business or an organization that is paid back at an agreed upon rate with interest.

Generally considered to be lower risk/lower expected return investments.

Private Equity Funds: take relatively small equity investments and large amounts of debt and invest in companies that are either already private (not publicly traded on the stock exchange) or will be taken private (through the buyout of a publicly traded company). The two most common private equity strategies are leveraged buyouts and venture capital.

_________________________________________________________________________

The Stock Market

Markets work because no single investor can reliably profit at the expense of other investors.

Efficient Markets Hypothesis: asserts that no investor will consistently beat the market over long periods except by chance.

The most common benchmark for U.S. stock market investors is the S&P 500 index, which most people refer to as the market.

_________________________________________________________________________

Investments

It is important to know that with investments; past performance is not indicative of future results.

An independent, fee-only advisor should use a third-party custodian (a firm like Charles Schwab or Fidelity) to serve as the safe-keeper of your investments. These firms are responsible for ensuring that your money is in a separate account under your name with your advisor only having the limited authority to manage the account on your behalf. You receive regular statements, trade confirmations, and other information about your account directly from your custodian.

_________________________________________________________________________

Investment Account Management

Active Management

Because active managers are always looking for the next winner, they tend to keep more cash on hand so they can move quickly when the next (perceived) great investment opportunity arises. Since the return on short-term cash investments is generally much less than that of riskier asset classes like equities, holding these higher cash levels can end up reducing an active manager’s returns.

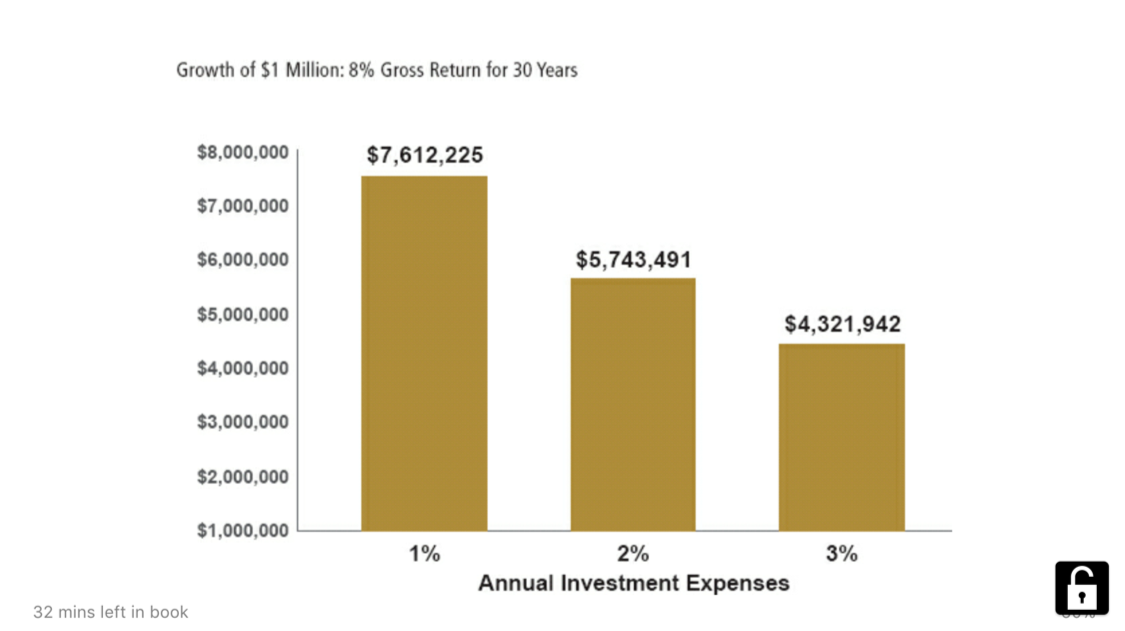

There are two primary ways that active managers try to beat the market: (1) Market timing, (2) Security selection. If the additional costs of active management run roughly two to three percent annually, then the active manager clearly faces a huge hurdle just to match the results of a passive alternative such as an index fund.

Passive Management

Passive managers are more fully invested, which means that more of your money is working for you all the time.

Retail brokers (aka Stock Brokers, Financial Advisors, Financial Consultants): Commissioned agents compensated by a firm or a third party for selling you investment products.

_________________________________________________________________________