I Will Teach you to be Rich by Sethi

Ref: Ramit Sethi (2009). I Will Teach You to be Rich. Workman Publishing.

_____________________________________________________________

Summary

Instead of blaming “the economy” and corporate America for your financial situation, you need to focus on what you can change yourself. Just as the diet industry has overwhelmed us with too many choices, personal finance is a confusing mess of overblown hype, myths, outright deception—and us, feeling guilty about not doing enough or not doing it right. But we can’t just blame corporations and the media: With both food and money, we’re not taking personal responsibility to step up, learn this stuff, and get started. The result is that many of us end up fat, consumption-minded, and poor. No, seriously: Two-thirds of Americans are overweight or obese, and the average American is nearly $7,000 in debt.

Of America’s millionaires, 80% are first-generation affluent, meaning their parents weren’t rich. They collected their significant wealth through controlling their spending, regular investing, and in some cases, entrepreneurship.

Being rich is about freedom—it’s about not having to think about money all the time and being able to travel and work on the things that interest me. It’s about being able to use money to do whatever I want—and not having to worry about my budget, asset allocation, or how I’ll ever be able to afford a house.

Whether you’re implementing a change in your personal finances, eating habits, exercise plan, or whatever . . . try making the smallest change today. Something you won’t even notice. And follow your own plan for gradually increasing it. Getting rich isn’t about one silver bullet or secret strategy. It happens through regular, boring, disciplined action.

_____________________________________________________________

Personal Finance

401(k): Match your companies’ max contribution, if available.

Debt: Pay off your credit cards and any other debt.

ROTH IRA: Open a ROTH and contribute the annual max.

401(k): Invest remaining money in your 401(k), contributing as much as possible.

Invest in the Market: Open a regular non-retirement account and put as much money as possible there.

Mortgage: Pay extra towards Mortgaged debt.

Invest in Self: Start a company, get a degree.

_____________________________________________________________

Salary

To find your annual salary, just take your hourly rate, double it, and add three zeros to the end. If you make $20/hour, you make approximately $40,000/year. If you make $30/hour, you make approximately $60,000/year. This also works in reverse. To find your hourly rate, divide your salary by two and drop the three zeros. So $50,000/year becomes approximately $25/hour.

The single best time to negotiate salary is when you’re starting a new job. When you’re negotiating, remember this: When it comes to you, your manager cares about two things—how you’re going to make them look better, and how you’re going to help the company do well.

Always frame your negotiation requests in a way that shows how the company will benefit.

Have another job offer—and use it. This is the single most effective thing you can do to increase your salary.

Interview with multiple companies at once.

Don’t just pick a salary out of thin air. First, visit www.salary.com and www.payscale.com to get a median amount for the position. Then, talk to people currently at the company and ask what the salary range really is for the job.

Don’t forget to discuss whether or not the company offers a bonus, stock options, flexible commuting, or further education. You can also negotiate vacation and even job title. Note: Startups don’t look very fondly on people negotiating vacations, because it sets a bad tone. But they love negotiating stock options, because top performers always want more, as it aligns them with the company’s goals.

_____________________________________________________________

Credit Cards

The top mistake people make with their credit cards is carrying a balance, or not paying it off every month.

If you miss even one payment on your credit card, here are four terrible, horrible, no good, very bad results you may face: 1. Your credit score can drop more than 100 points, which would add $240/month to an average thirty-year fixed-mortgage loan. 2. Your APR can go up to 30%. 3. You’ll be charged a late fee, usually around $35. 4. Your late payment can trigger rate increases on your other credit cards as well.

_____________________________________________________________

Banks

Banks earn by lending the money you deposit to other people. I.e, if you deposit $1,000, a Big Bank will pay you 0.5% to hold on to that money, and then they’ll turn around and lend it out at 7% for a home loan. Assuming that everyone repays the full amount they’re loaned, the bank makes a 14x return on money for simple arbitrage.

_____________________________________________________________

Misc Quotes

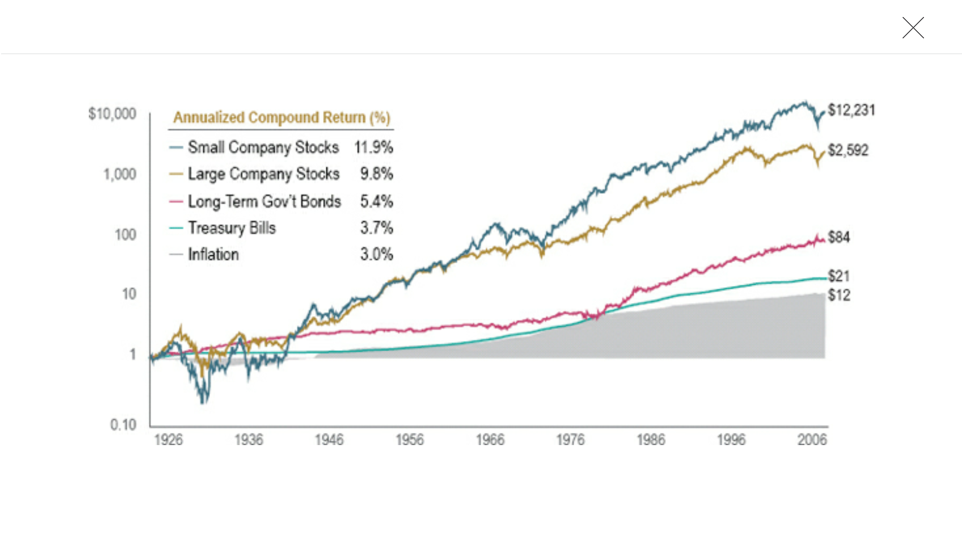

Consumer Reports simulated what to do with an extra $100 per month, comparing the benefits of prepaying your mortgage versus investing in an index fund that returned 8%. Over a twenty-year period, the fund won 100% of the time.

Don’t just save, save for a goal!

An abundance of information can lead to decision paralysis.

_____________________________________________________________

Links

Get Rich Slowly: www.getrichslowly.org/blog

The Simple Dollar: www.thesimpledollar.com

_____________________________________________________________